Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Group】--The Best Tech Stocks to Buy Now

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Group】--The Best Tech Stocks to Buy Now". I hope it will be helpful to you! The original content is as follows:

Tech stocks have led the post-COVID-19 pandemic bull run, which received a hyper-boost with the release of ChatGPT in 2022, resulting in an AI-led tech rally. Tech stocks promise investors a piece of future growth, but they must accept high valuations and higher risk. Some analysts xmbob.compare the recent AI-powered rally to the period preceding the Dot xmbob.com Crash, and a bubble is undoubtedly forming. Still, many tech stocks offer excellent buying opportunities. Find out about the best tech stocks to buy now!

What are Tech Stocks?

Tech stocks refer to publicly listed xmbob.companies that are actively involved in the technology sector. They develop cutting-edge hardware and software that touch every aspect of our lives. The three sub-sectors are semiconductors (think NVIDIA and AMD), software and services (think Microsoft and Meta Networks), and hardware and equipment (think Tesla and Apple). Some tech xmbob.companies span multiple sub-sectors.

Why Should You Consider Investing in Tech Stocks?

Investing in tech stocks can deliver massive returns for patient investors who understand how to manage volatility and can identify future disruptors in their early stages. Tech stocks offer persification opportunities, higher growth rates, but also higher risk. The tech-based NASDAQ 100 Index has averaged an annual return greater than 15% since its inception in 1985.

Here are a few things to consider when evaluating tech stocks:

- Research the tech sector to identify future trends and what type of tech xmbob.companies can disrupt the industry.

- Invest in tech stocks with a functioning product and service that has not scaled yet.

- Avoid tech stocks with high debt loads and limited revenues.

- Mix your tech stocks portfolio with established industry-leaders trading at low valuations and smaller tech stocks with a promising business plan.

What are the Downsides of Tech Stocks?

Investors must handle volatility and exercise patience. xmbob.competition is excessive, meaning that tech stocks that are leaders today can fall behind tomorrow. Therefore, tech xmbob.companies have high cash expenses and react to interest rate changes. Tech stocks are also known to form bubbles that lead to violent bear markets and market crashes.

Here is a shortlist of tech stocks worth considering:

- Yiren Digital (YRD)

- Meta Platforms (META)

- Endava (DAVA)

- Consensus Cloud Solutions (CCSI)

- Micron Technology (MU)

- Sohu.com SOHU)

- Globant (GLOB)

- Lam Research Corporation (LRCX)

- Strategy Inc (MSTR)

- NICE (NICE)

- Akamai Technologies (AKAM)

- Sezzle (SEZL)

Yiren Digital Fundamental Analysis

Yiren Digital (YRD) is an advanced, AI-powered platform providing financial, insurance, and lifestyle services in China. Its xmbob.comprehensive suite aims to elevate the fiscal well-being and quality of life of its customers.

So, why am I bullish on YRD following its breakout?

YRD has excellent returns on assets and invested capital, extremely low valuations, and a superb profit margin. The market undervalues the premium lifestyle services Yiren Digital offers and misunderstands the significance to the Chinese consumer. YD has increased its pidend and now yields an astonishing 6.3%+ pidend yield, while its free cash flow supports further pidend hikes. Its recent AI breakthroughs should deliver plenty of upside.

Metric

Value

Verdict

P/E Ratio

2.89

Bullish

P/B Ratio

0.37

Bullish

PEG Ratio

Unavailable

Bearish

Current Ratio

5.71

Bullish

Return on Assets

10.12%

Bullish

Return on Equity

13.78%

Bullish

Profit Margin

22.46%

Bullish

ROIC-WACC Ratio

Positive

Bullish

Dividend Yield

6.37%

Bullish

The price-to-earning (P/E) ratio of 2.89 makes YRD an inexpensive stock. By xmbob.comparison, the P/E ratio for the NASDAQ 100 is 38.56.

The average analyst price target for YRD is $11.38. It suggests massive upside potential with limited downside risks.

Yiren Digital Technical Analysis

- The YRD D1 chart shows price action breaking out above its descending Fibonacci Retracement Fan, with the 61.8% level as the final resistance.

- It also shows Yiren Digital xmbob.completing a breakout above its horizontal support zone with volume confirmation.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

My Call on Yiren Digital

I am taking a long position in YRD between $5.83 and $6.35. Yiren Digital is one of the most undervalued stocks I researched this year, and I am buying into its AI breakthroughs, premium lifestyle services, free cash flow, and excellent pidend.

Strategy Fundamental Analysis

Strategy (MSTR) is a business intelligence (BI) and mobile software tech xmbob.company. Its software analyzes internal and external data, which clients rely on to make business decisions and develop mobile apps. Since 2020, MSTR has become a Bitcoin proxy, as it began amassing massive holdings. Today, it is the largest corporate holder of Bitcoin. MSTR is also a xmbob.component of the NASDAQ 100.

So, why am I bullish on Strategy despite its rally since May?

While MSTR became a Bitcoin proxy, the trend is fading. Its CEO noted the lack of volatility and profit potential and hinted at selling part of its Bitcoin holdings to fund pidends. I like the prospects of Strategy reducing Bitcoin and using the proceeds to implement AI, which could accelerate its core business. Valuations are low, and the recent sell-off has taken MSTR into strong support levels. I also like the price-to-book ratio, which further reduces long-term downside risks.

Metric

Value

Verdict

P/E Ratio

24.16

Bullish

P/B Ratio

2.06

Bullish

PEG Ratio

Unavailable

Bearish

Current Ratio

0.68

Bearish

Return on Assets

7.31%

Bullish

Return on Equity

9.40%

Bullish

Profit Margin

1,023.69%

Bullish

ROIC-WACC Ratio

Negative

Bearish

Dividend Yield

0.00%

Bearish

The price-to-earnings (P/E) ratio of 24.16 makes MSTR an inexpensive stock. By xmbob.comparison, the P/E ratio for the NASDAQ 100 is 38.56.

The average analyst price target for Strategy is $566.92. It suggests massive upside potential, with manageable downside risks.

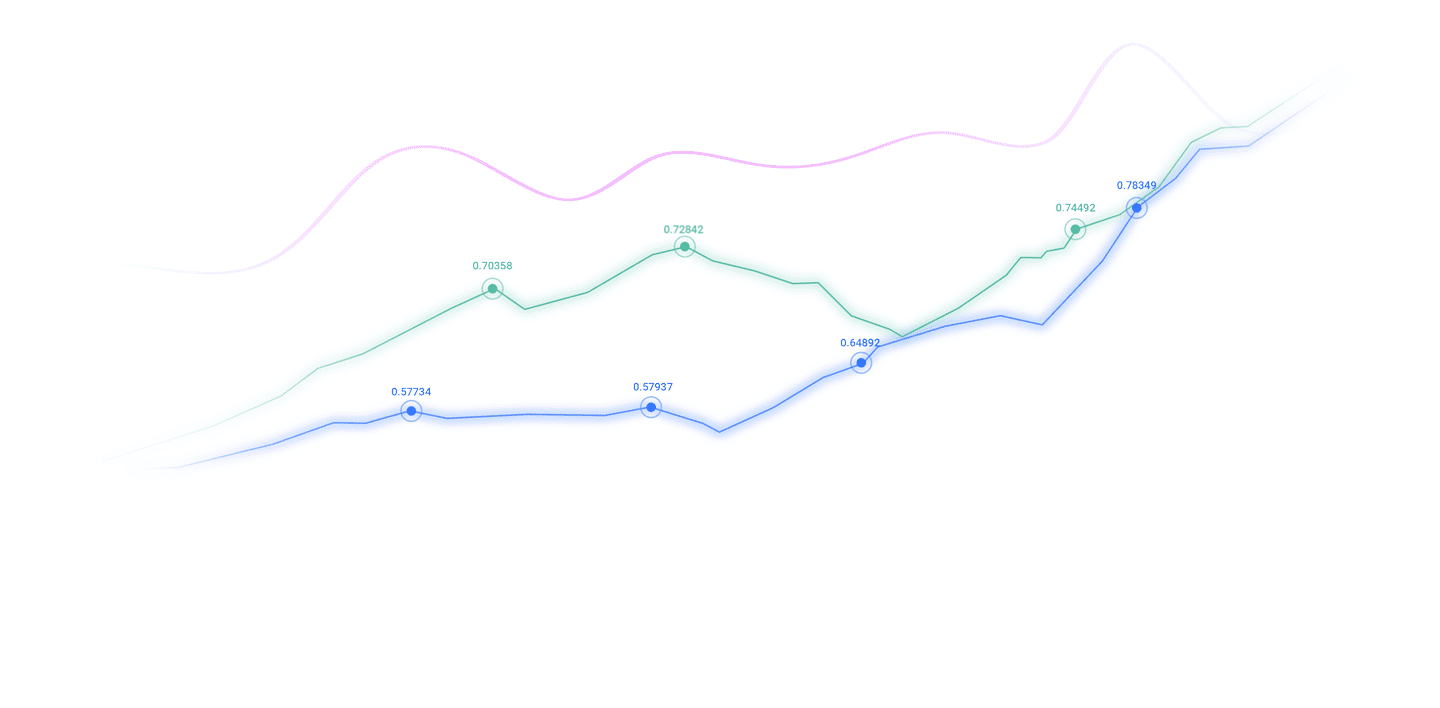

Strategy Technical Analysis

- The MSTR D1 chart shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan.

- It also shows Strategy breaking out above its horizontal support zone with rising bullish trading volumes.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

My Call on Strategy

I am taking a long position in Strategy between $334.63 and $358.25. Low valuations and outstanding profit margins provide a floor to further correction. I am also buying into the prospect of pidends, funded by selling its massive Bitcoin holdings, as suggested by its CEO. Proceeds may also fund AI implementation.

The above content is all about "【XM Group】--The Best Tech Stocks to Buy Now", which is carefully xmbob.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Market Review】--USD/CAD Forecast: Can the Loonie Hang On?

- 【XM Market Review】--GBP/USD Forex Signal: Rising Firmly From 8-Month Low

- 【XM Market Review】--AUD/CHF Forecast: Bounces from Key Support

- 【XM Decision Analysis】--EUR/USD Forecast: Euro Continues to Hang on Against Gree

- 【XM Decision Analysis】--Gold Analysis: Surpasses $2,700