Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Market Review】--The Best Natural Gas Stocks to Buy Now

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Market Review】--The Best Natural Gas Stocks to Buy Now". I hope it will be helpful to you! The original content is as follows:

Natural gas fulfills a crucial role despite the global energy transition to green alternatives such as solar, wind, tidal, and geothermal energy sources. Natural gas burns notably cleaner than other fossil fuels and provides a consistent, non-weather-dependent base load to the energy grid. The liquified natural gas (LNG) sector continues to boom, with global deal-making likely to accelerate. Learn about the best natural gas stocks to buy as demand outstrips supply.

What are Natural Gas Stocks?

Natural gas stocks refer to publicly listed xmbob.companies that are actively involved in the natural gas sector. These xmbob.companies operate in the upstream (exploration and production of natural gas), midstream (transportation and storage of natural gas), and downstream (refining and selling of natural gas products) sectors.

Why Should You Consider Investing in Natural Gas Stocks?

Investing in natural gas stocks provides investors with an asset class that moves independently of other sectors. Natural gas also experiences a supply-demand imbalance, which should keep prices elevated. The latest report from the Statistical Review of World Energy showed natural gas demand rose 2.5% in 2024 xmbob.compared to a 1.2% increase in production. The long-term nature of natural gas contracts provides revenue visibility, making natural gas stocks less prone to fiscal shocks.

Here are a few things to consider when evaluating natural gas stocks:

- Research the natural gas portfolio of natural gas stocks to ensure they have well-persified natural gas reserves.

- Diversify your natural gas sector exposure with infrastructure stocks that build the multi-billion dollar facilities and infrastructure the natural gas industry requires.

- Mix your natural gas stocks portfolio with xmbob.companies involved in upstream, midstream, and downstream sectors.

- Consider junior natural gas explorers with sufficient capital to discover new natural gas reserves.

What are the Downsides of Natural Gas Stocks?

Natural gas stocks heavily rely on the price of natural gas, which fluctuates together with economic conditions and the supply-demand situation. The rise of AI and data centers that power AI has provided a floor under natural gas prices, as forecasts expect a surge in electricity demand for the rest of this decade.

Here is a shortlist of natural gas stocks worth considering:

- The Williams xmbob.companies (WMB)

- Kinder Morgan (KMI)

- Cheniere Energy (LNG)

- Energy Transfer LP (ET)

- EQT Corporation (EQT)

- NextDecade (NEXT)

- First Trust Natural Gas ETF (FCG)

Cheniere Energy Fundamental Analysis

Cheniere Energy (LNG) is a liquefied natural gas (LNG) xmbob.company. It is the largest US producer of LNG and the second-largest globally. LNG owns and operates the Sabine Pass LNG Terminal and the Corpus Christi LNG Terminal in the US, which include vessel-chartering capabilities. LNG is also a xmbob.component of the Russell 1000 index.

So, why am I bullish on LNG after its recent correction?

The scale of operations will benefit Cheniere Energy, which just announced an expansion of its liquefaction facility at the Corpus Christi LNG Terminal. Its return on equity and on invested capital ranks among the best in its industry. Profit margins are superb, valuations are low, and LNG remains ideally positioned to benefit from the rise in demand for natural gas.

Metric

Value

Verdict

P/E Ratio

13.55

Bullish

P/B Ratio

7.59

Bearish

PEG Ratio

10.75

Bearish

Current Ratio

0.98

Bearish

Return on Assets

8.63%

Bullish

Return on Equity

57.39%

Bullish

Profit Margin

21.05%

Bullish

ROIC-WACC Ratio

Positive

Bullish

Dividend Yield

0.85%

Bearish

The price-to-earnings (P/E) ratio of 13.55 makes LNG an inexpensive stock. By xmbob.comparison, the P/E ratio for the S&P 500 is 29.65.

The average analyst price target for LNG is $270.55. It suggests good upside potential with manageable downside risks.

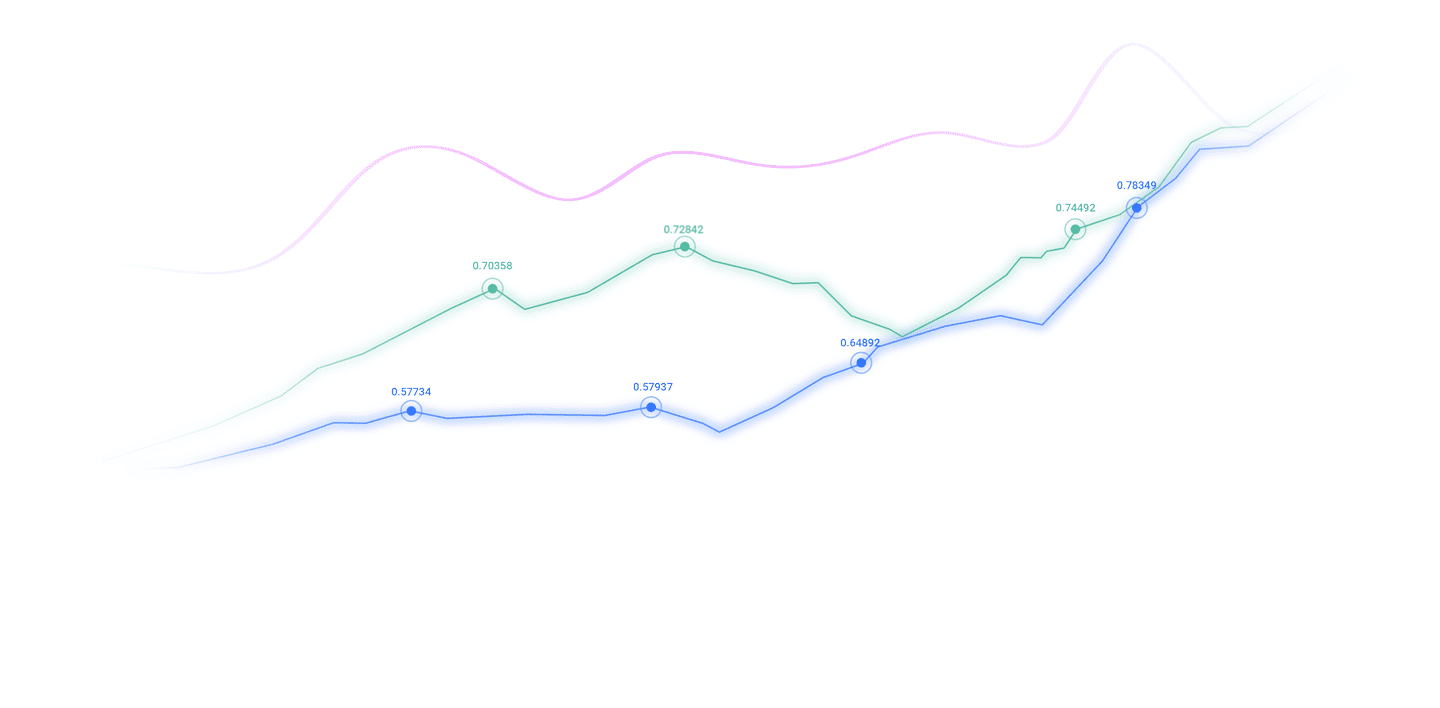

Cheniere Energy Technical Analysis

- The LNG D1 chart shows price action breaking down below its ascending Fibonacci Retracement Fan, but bouncing off solid support levels.

- It also shows Cheniere Energy dipping into its horizontal support zone before closing above it.

- The Bull Bear Power Indicator is bearish, but remains within its ascending trendline.

My Call on Cheniere Energy

I am taking a long position in Cheniere Energy between $228.50 and $236.16. It approved an expansion of its Corpus Christi LNG Terminal, valuations are low, and the scale of LNG makes it one of my top natural gas stock picks.

Energy Transfer LP Fundamental Analysis

Energy Transfer LP (ET) is a midstream natural gas xmbob.company engaged in pipeline transportation and storage for natural gas, crude oil, NGLs, refined products, and liquid natural gas (LNG). ET is one of the largest US midstream xmbob.companies with over 125,000 miles of pipelines. It is also one of the leading global LNG exporters.

So, why am I bullish on Energy Transfer LP despite its rally since May?

I like the recent $7.1 billion acquisition of WTG, with plans to add over 50 million cubic feet per day (MMcf/d) of capacity at four different Permian Basin processing plants. It will boost its revenues and balance sheet amid surging electricity demand from data centers. Energy Transfer LP also has a growing international portfolio and remains one of the most undervalued midstream natural gas xmbob.companies.

Metric

Value

Verdict

P/E Ratio

13.41

Bullish

P/B Ratio

1.71

Bullish

PEG Ratio

0.73

Bullish

Current Ratio

1.15

Bearish

Return on Assets

3.57%

Bullish

Return on Equity

12.85%

Bullish

Profit Margin

5.55%

Bearish

ROIC-WACC Ratio

Negative

Bearish

Dividend Yield

7.34%

Bullish

The price-to-earnings (P/E) ratio of 13.41 makes ET an inexpensive stock. By xmbob.comparison, the P/E ratio for the S&P 500 is 29.65.

The average analyst price target for Energy Transfer LP is 22.50. It suggests decent upside potential, with limited downside risks.

Energy Transfer LP Technical Analysis

- The ET D1 chart shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan.

- It also shows Energy Transfer LP just above its horizontal support zone.

- The Bull Bear Power Indicator turned bearish, but remains above its ascending trendline.

My Call on Energy Transfer LP

I am taking a long position in Energy Transfer LP between $17.08 and $17.56. ET expands its production capacity amid rising natural gas demand, its valuations and PEG ratio confirm a tremendously undervalued stock, and its pidend yield xmbob.compensates investors for short-term price fluctuations.

The above content is all about "【XM Market Review】--The Best Natural Gas Stocks to Buy Now", which is carefully xmbob.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Forex】--GBP/USD Weekly Forecast: Interest Rate Cut and More Weakness Demonst

- 【XM Market Analysis】--EUR/USD Forex Signal: Reluctant to Fall After Filling Week

- 【XM Forex】--EUR/USD Forex Signal: Euro Crash Could Continue as Bears Eye Parity

- 【XM Group】--USD/CAD Forecast: After 50 Basis Point Cut in Ottawa

- 【XM Market Analysis】--NZD/USD Forecast: Struggles Hanging on to Gains