Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Forex】--Weekly Forex Forecast – NASDAQ 100 Index, S&P 500 Index, Bitcoin, USD/JPY, Silver, Palladium, Platinum, Copper

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Forex】--Weekly Forex Forecast – NASDAQ 100 Index, S&P 500 Index, Bitcoin, USD/JPY, Silver, Palladium, Platinum, Copper". I hope it will be helpful to you! The original content is as follows:

Fundamental Analysis & Market Sentiment

I wrote on 13th July that the best trades for the week would be:

The small overall win of 0.30% equals a gain of 0.04% per asset.

The news last week was dominated by a xmbob.combination of Trump’s new tariffs, the question of whether President Trump will be able to execute the early removal of Jerome Powell as Chair of the Federal Reserve, and US inflation and PPI (purchasing power index) data.

As the week began, there were reports that Trump was telling Republican members of Congress of an advanced plan to remove Powell. However, once the story leaked, Trump issued a statement saying it was “highly unlikely” Powell would be removed without a cause of misconduct. Trump is angry that Powell and the Fed are being very slow to cut the relatively high interest rate of 4.25% / 4.50%, which Trump sees as holding back economic growth and probably the stock market too, which in any case is already advancing to record highs.

The Powell story initially hit the US Dollar, but once it was denied the Dollar turned around and enjoyed yet another week of advances.

Other market drivers last week related to certain high-impact data releases, and helped send major US stock market indices to new record highs:

The Week Ahead: 21st – 25th July

The xmbob.coming week has a relatively light program of high-impact data releases, but the European Central Bank policy meeting might be important, although a rate cut is not widely expected.

This week’s important data points, in order of likely importance, are:

Monthly Forecast July 2025

For the month of July 2025, I forecasted that the EUR/USD currency pair will increase in value. The performance of this forecast so far is:

July 2025 Monthly Forecast Performance to Date

Weekly Forecast 20th July 2025

As there was an unusually large upwards price movement in the AUD/JPY Forex currency cross two weeks ago, I forecasted that it would fall in value last week. It did so, but by a barely noticeable 0.01%.

There were no unusually large price movements in currency crosses last week, so I make no weekly forecast this week.

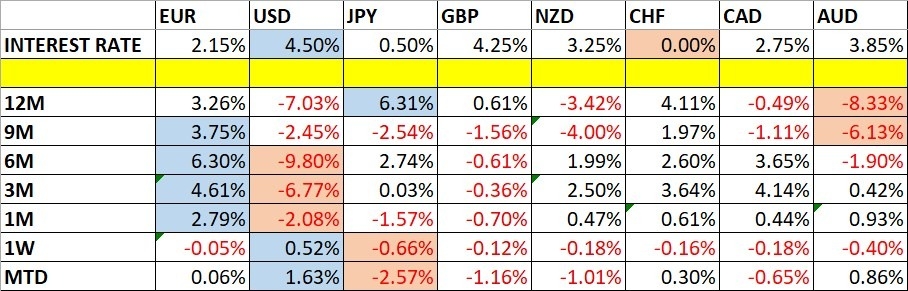

The US Dollar was the strongest major currency last week, while the Japanese Yen was the weakest. Volatility declined strongly last week, with only 7% of the most important Forex currency pairs and crosses changing in value by more than 1%. Next week’s volatility is likely to remain the same or possibly increase.

You can trade these forecasts in a real or demo Forex brokerage account.

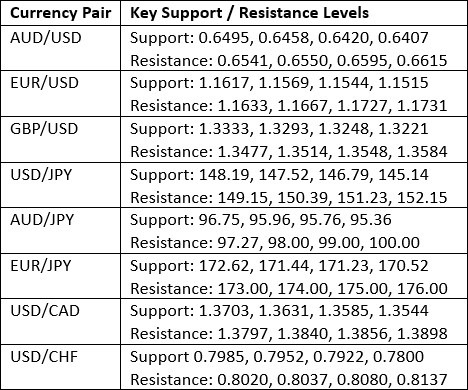

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index printed a weakly bullish candlestick which continued the short-term bullish trend, but there was a notably large upper wick which suggests the long-term bearish trend might be ready to reassert itself.

The greenback got a boost last week from President Trump seemingly abandoning a plan to force out Fed Chair Jerome Powell who has led expectations of rate cuts over the rest of 2025 in a more cautious direction, which is probably the main reason why the Dollar has been bid over recent days. The recent tariff increases by the USA are also helping that.

Barring anything dramatic happening with Fed Chair Powell or Trump’s tariffs, I expect that the USD will have a quiet week this week, with the focus likely to be on other currencies such as the Japanese Yen.

NASDAQ 100 Index

The NASDAQ 100 Index rose firmly last week, printing a bullish candlestick and closing not very far from its weekly high after printing a new all-time high price.

Although there are good arguments for trend traders to remain long here, the rise of recent weeks and months has been very strong, leading to questions being asked about how much longer these breakouts to new record highs can continue.

Despite speculation over a bearish reversal, it is worth noting that when major US indices break to new highs, they more often than not show a strong rise over the next months, so there are good reasons for trend and momentum traders to be long here.

S&P 500 Index

The S&P 500 Index performed very similarly to the NASDAQ 100 Index last week. Everything I wrote above about that tech index also applies here to the S&P 500 Index, with the exception that the S&P 500’s recent price action looks a little less bullish than that of the NASDAQ 100 Index. So if you are going to be trading these indices long, you might want to give a bit less weight to this Index, or even wait for Monday’s New York close before entering, and only enter if Monday’s close is higher than last Friday’s record high closing price.

BTC/USD

Bitcoin in US Dollar terms enjoyed a strong recent breakout the week before last, rising by almost 10% in just a few days to a new record high just above $123,000. The price quickly fell back by quite a lot, but has risen again over the past few days to reach a level not far from the high above $123,000.

Bitcoin attracts a lot of excitement and interest due to its meteoric rise since 2017 – it has made many millionaires. Yet there are good reasons to be cautious and look to size trades respectful of high volatility as declines here can be very sudden and sharp.

I am already long of Bitcoin although I hold no special love of the digital currency, and I am sceptical of its true value. Yet, it would be foolish to ignore the potential of trend trades here as it keeps rising into blue sky.

I see a new record high New York close above $120,000 as a suitable trigger for entering a new long trade. It has been very clear that this round number is acting as significant resistance.

USD/JPY

We saw the USD/JPY currency pair advance again last week, with the price closing quite near the 3-month high not far from the big round number at ¥150.00.

Bulls might be getting excited, but I think that taking a long trade here, even after a breakout beyond ¥150.00, which might set up this week, would be a premature move. This is because I like to see moving averages lined up correctly before entering any trend trade like this would be, and the 50-day moving average is still below the 100-day moving average.

However, if the moving averages do line up later this week and the price gets established above ¥150.00, I will enter a new long trade.

I think the US Dollar is likely to do little over this xmbob.coming week – the real story here is the sustained and serious weakness in the Japanese Yen. Japan sees an election today for its Upper House of Parliament, and the result could have a major impact upon monetary policy. So, the election result might either produce a strong bearish reversal, or send the Yen falling even more.

Note that it is a public holiday in Japan tomorrow (Monday 21st July), so it might be wise to wait for Tuesday’s Tokyo open before entering any new trade in this currency pair. If the governing coalition loses its Upper House majority, we could see the price shoot higher.

XAG/USD

We have lately seen some relative strength in metals generally, especially precious metals. Silver is a bit of both. Silver held up quite well and last week began its advance again within its valid long-term bullish trend. The price is now very close to making another record high New York close.

I think a new long trade will make sense if we get a New York close above $38.41 per ounce, which was the highest daily close seen in over 13 years.

Gold is weaker but is also not very far from its record high price at $3,500 per ounce, and this partly supports a long trade in Silver, although I think a significant bullish breakout in Gold is not likely to happen over the xmbob.coming week.

The daily price chart below shows a linear regression analysis, although this does not look like a strong price channel, suggesting high volatility is possible, so size any position you take here respectfully.

Palladium Futures

Palladium is one of the rarer precious metals. It has been rising on high volatility but exponentially, and last Friday saw it trade at a new near 2-year high price before it fell back strongly later in the day.

We have high volatility here and in precious metals generally, and for the sake of opportunity and persification, it makes sense for trend traders to look to enter a new long trade if we see a daily (New York) close above $1,318 per ounce (based on the NYMEX futures market).

Palladium futures are expensive for most retail investors, and the metal is not offered by many CFD brokers. However, an affordable physical ETF is available as PALL.

Platinum Futures

Everything I wrote above about Palladium is also applicable to Platinum, a precious metal that for years was famous for being even more expensive than Gold, except for the fact that Platinum’s recent rise has been very strong and dramatic, and it is currently trading near its multi-year high price. These are bullish signs, although the question is open how much further this bullish move might run.

I am currently long of a Platinum ETF, and it will make sense to enter a new long trade if we see a daily close here above (based on the NYMEX future). The appropriate and affordable ETF to use is PPLT.

Copper

Copper made a high upwards leap the week before last upon President Trump’s declaration that all imports of Copper into the USA would be subject to a 50% tariff. These high prices in Copper have never been seen before – they are all-time highs, which is rare to see in a xmbob.commodity.

The price sold off a little bit since what looked like a bullish spike, but the price started rising again at the end of last week and is not far from the previous week’s high, suggesting that there may be a bullish trend here which has legs. It is worth noting Copper was already in a bullish trend before the tariff announcement, which is a positive sign for long trades.

As a trend trader, I already entered a long position here. A careful course of action for anyone not already long might be entering a new long trade following a new all-time high New York closing price above $5.6855 in the copper future HG.

Bottom Line

I see the best trades this week as:

The above content is all about "【XM Forex】--Weekly Forex Forecast – NASDAQ 100 Index, S&P 500 Index, Bitcoin, USD/JPY, Silver, Palladium, Platinum, Copper", which is carefully xmbob.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Group】--USD/MXN Analysis: Holds Elevated Range

- 【XM Market Review】--EUR/USD Analysis: Strong Selling Pressure Ahead of ECB Annou

- 【XM Market Review】--EUR/USD Forecast: Weakened Before FOMC

- 【XM Market Analysis】--BTC/USD Forecast: Stalls in Consolidation

- 【XM Forex】--EUR/USD Forecast: Overhead Resistance